Skip to content

Transportation Services

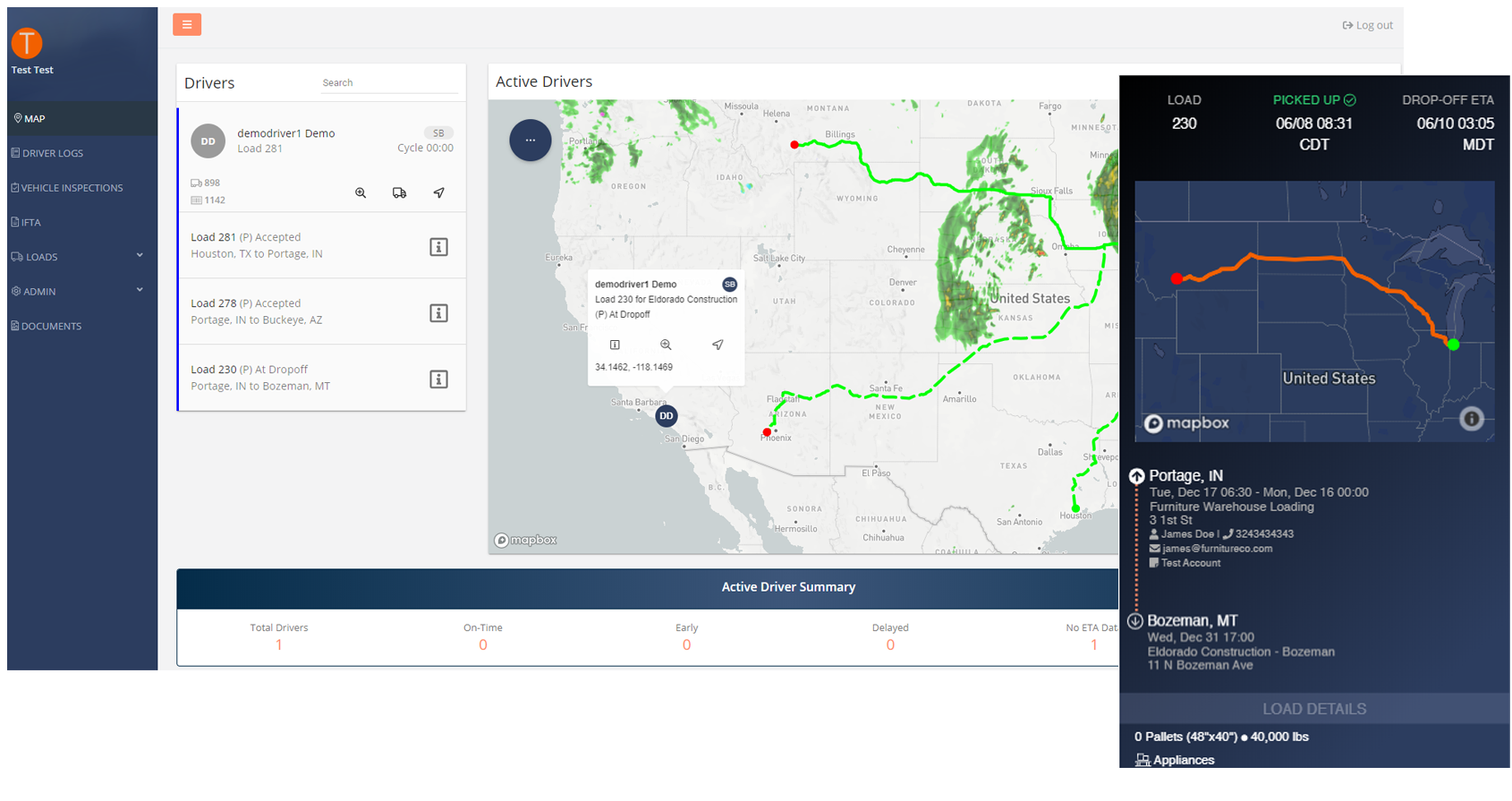

Driver Mobile App

Truckstops, fuel discounts, ELD, Dispatch, and Document Scanning all in one free app.

Telematics & Safety

Collaborate with Trading Partners

Connect with vendors and customers to seamlessly communicate shipment information all without any integration headaches.

Telematics & Safety

English